Ho Chi Minh City - 09 July 2021

HCMC Office Market

In Q2 2021, the HCMC office market had one new Grade B office building which was AP Tower in Binh Thanh District, adding 10,841 sqm of NLA to the total supply. The second quarter of 2021 witnessed the new wave of COVID-19 in which recent cases rose to a record high since the initial outbreak. Many companies were more open to working from home or rotation policy. According to CBRE APAC Survey, in the short term, there was a notable rise in the number of companies which prefer 1-4 days /month policy for working from home and decrease in the number of companies which require working at office at all times. In HCMC, landlords offer support case by case, for example, free rent and/or service charge for companies which were forced to close because of the pandemic and more lenient policy for renewal contract. As of Q2 2021, the total supply was 1,433,327 sqm NLA from 18 Grade A buildings and 69 Grade B buildings.

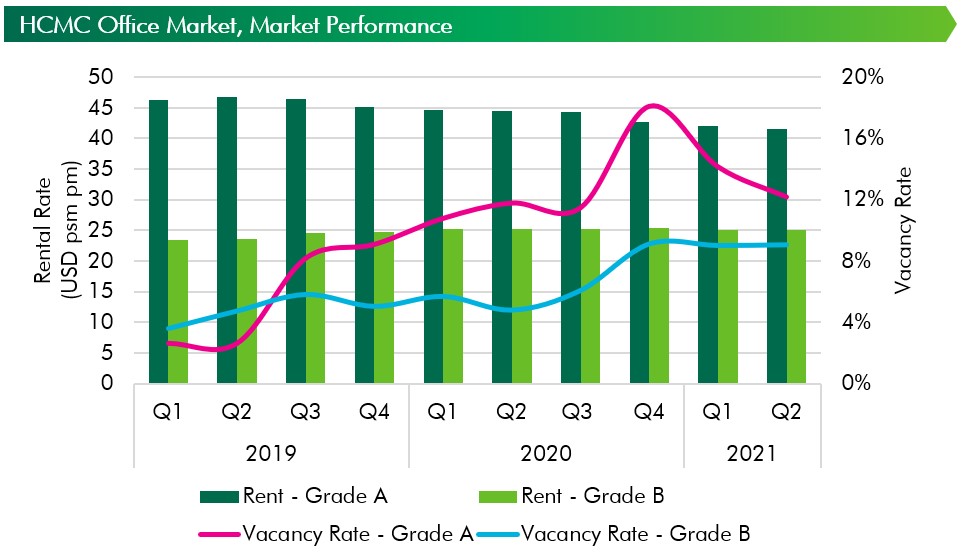

In terms of market performance, vacancy in Grade A continued to decrease by 2 ppt q-o-q mostly due to new leased areas at newly buildings in District 1 and District 7, which offer high quality and closeness to existing office clusters. In the Grade B segment, the vacancy rate was stable while old buildings continued to witness occupier return spaces and move to newer buildings in Tan Binh District, District 1, District 2 and District 7 and Binh Thanh District. As of Q2 2021, the vacancy rate of Grade A and Grade B segments was 12.2% ( up 0.4 ppts y-o-y) and 9.1% (up 4.3 ppts y-o-y), respectively. Regarding the rental rate, Grade A’s decrease trend has slowed down to 1.2% q-o-q while Grade B’s rental rate was stable. The rental rate of Grade A and Grade B was USD 41.6 psm pm (down 6.4% y-o-y) and 25.1 psm pm (down 1.0% y-o-y), respectively. Net absorption was positive for Q2 2021 at both Grade A and Grade B building, bringing total net absorption for H1 2021 to over 33,300 sqm NLA.

Based on CBRE’s transaction, renewal and expansion accounted for 82% of the total number of transactions in Q2 2021. Top four leading industries were Information Technology, Finance/Banking, Logistics and Retail/Trade/E-commerce, accounting for 78% of total transacted areas. Manufacturing and Flexible Workspace, although being active prior to 2020, was hit hard by the pandemic and did not expand strongly at conventional office buildings.

In the last six months of 2021, the market is expected to welcome three new more Grade B buildings, with a total NLA of 34,500 sqm of NLA. Until 2022 forwards, the city will receive more Grade A new supply, for example Etown 6, One Central and new prime office in Thu Thiem New Urban area. According to Thanh Pham, Associate Director of CBRE Vietnam, Research & Consulting: “Although in the short term, the market is uncertain due to effect of new COVID-19 wave, the outlook in the medium term is positive. New supply with a focus on high quality and adoption of green/wellness credentials are a strongly growing trend, which will add value to landlords’ portfolio”.

HCMC Retail Market

In Q2 2021, Co.opmart Truong Chinh in Tan Phu District opened with 16,000 sqm of NLA . After several quarters without new supply; as of Q2 2021, the total retail supply in HCMC was at 1,068,128 sqm NLA. Because of the new wave of COVID-19, all shopping centres were forced to close starting from June 2021, except for necessary categories such as supermarket, pharmacy. However, the part-opening policy will be even more restricted in Q3 2021, given the rising number of new COVID-19 cases and more challenges in controlling the new virus variant.

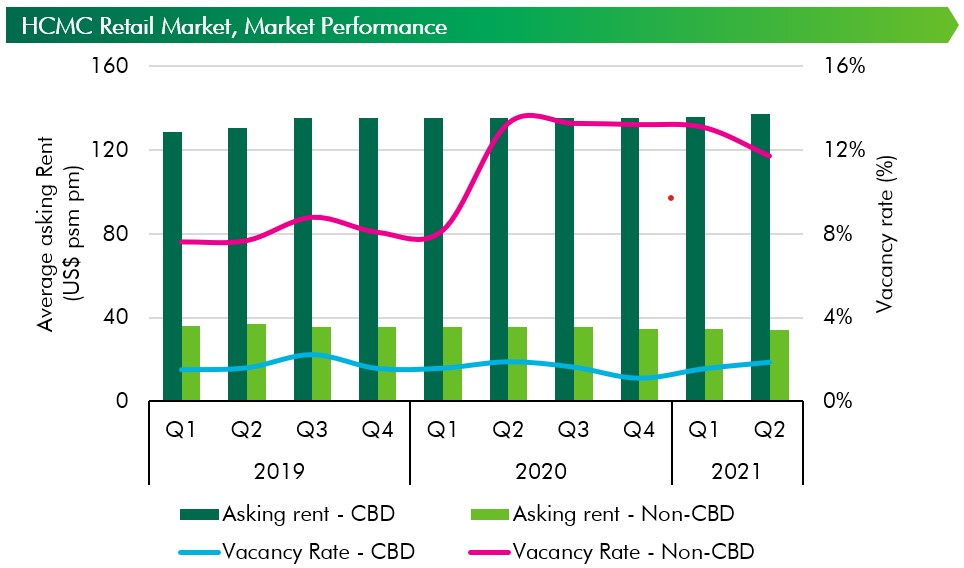

In Q2 2021, the vacancy rate in the non-CBD areas decreased by 1.4ppt q-o-q due to new openings of big anchor fashions such as Decathlon, Uniqlo in April and May; for the CBD area, the limitation in supply has kept vacancy at low level. As of Q2 2021, the vacancy rate for CBD and non-CBD areas were 1.87% (stable y-o-y) and 11.71% (down 1.7 ppts y-o-y), respectively. On June 2021, all shopping malls offer free rent and service charges for closed tenants; some landlords even offer 10%-50% rent reduction in May given the decrease in the number of footfall despite no forced closure, based on category. Some projects with vacant spaces that have not been filled for several quarters have lowered their asking rent or landlords focus on dealing/supporting existing tenants rather than looking for new fillings. As of Q2 2021, rental rate in the CBD is USD 137.1 psm pm, up 1.1% q-o-q (and up 1.2% y-o-y) and rental rate in the non-CBD is USD 33.9 psm pm, down 2.3% q-o-q (and down 5.2% y-o-y).

Big players continued to be active in the quarter. For example, Masan acquired 20% stake in Phuc Long to add to their new format of convenient store/coffee/banking combination. Nova F&B, an arm of Nova Group, continued partnering with Mango Tree after JUMBO, Crystal Jace Palace, Gloria Jean’s Coffee and others. These are activities in preparation that would benefit big players significantly once the pandemic is controlled and the economy revived. Smaller players, on the other hand, continued the struggle in waiting mode and streamline their operation to cut cost and shifting to an online platform, the trend which will continue more in the future; according to Euromonitor, online sales in Vietnam can grow double in five years.

The city is expected to have over 200,000 sqm of new retail spaces until 2023, both in CBD and non-CBD areas. In the short term, categories such as F&B, coffee chain, convenience store, health & beauty will continue to expand at retail podiums, opting more at residential blocks, before more shopping centres supply coming online. The market sentiment and consumer confidence is expected to recover rapidly once pandemic is thoroughly controlled as well as more vaccination is carried on throughout the nation. According to Thanh Pham, Associate Director of CBRE Vietnam, Research & Consulting: “To adapt to the new normal in retail, retailers are working their best to deliver a higher standard of customer experiences. Focused categories would be fashion, health and beauty. Online shopping during pandemic times cannot satisfy consumer’s need for the actual in-store experience.”

HCMC Condominium Market

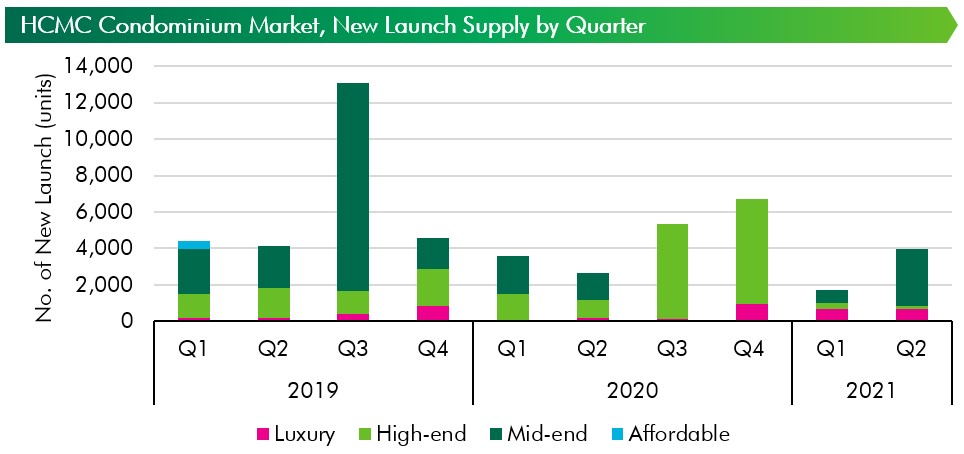

In Q2 2021, there were 3,968 condominium units launched in HCMC, which was double that of the previous quarter and showing a recovery of sales activities. However, with 5,600 units, the total new condominium launch in H1 2020 was still 9% lower y-o-y because of Covid-19 resurgence. In terms of segment, 79% of units launched in Q2 2021 were from the mid-end segment while the remaining were in the luxury and the high-end segment.

Sales momentum was relatively positive in Q2 2021 as compared to the previous quarter, with over 80% of units launched during the quarter having been absorbed. In Q2 2021 there were 4,700 sold units, increased by 76% q-o-q. The sales picked up in Q2 thanks to active sales activities before the travel restriction period. Diversification in sales channels (online channels combined with direct marketing via sales events, limited buyer per section, etc.) and the introduction of innovative sale policies have boosted the sales during the quarter. Local buyers are key focus of developers during the first half of the year as foreign sales have been disrupted due to the suspension of international flights since last year.

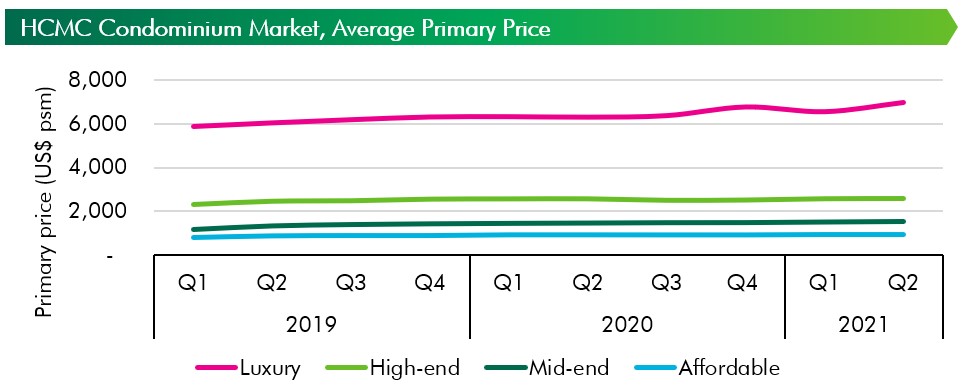

Selling prices in the primary market in Q2 2021 averaged US$2,260 per sqm (net of VAT), up by 16.5% y-o-y. The luxury and mid-end segments recorded high price escalation, 9.2% and 8.3% y-o-y, respectively. The significant price escalations were due to a lack of supply in the mid-end segment and the branded residence project in the luxury segment. High-end and affordable segments had modest growth rates in the review quarter, 0.4% and 1.6% y-o-y, respectively.

Moving forward, the level of new supply is expected to stay at around 17,000 - 18,000 units in 2021. Ms. Dung Duong – Senior Director, CBRE Vietnam noted “COVID-19 resurgence has changed the nature of residential sales positively and the market remains attractive. Developers are introducing innovative sales strategies while local buyers are adapting to the new normal. Vaccine visa and increasing vaccine rate will drive foreign buyers back to Vietnam”. The annual total of sold units might be around 15,000 – 17,000 units in HCMC given the limited supply and COVID-19 situation.

Primary prices will continue to increase at a slower pace so the market could absorb the remaining units. Primary prices will increase by 1%-4% y-o-y in all segments except the luxury segment. The luxury segment will increase by 6% in 2021 and 2022, thanks to new branded residence projects in District 1.

In the long-term, CBRE expected that home office solutions for condominiums such as a working area with sufficient light and air, sustainable design for energy saving will be a new trend as working from home getting longer. In terms of location, the market will expand further from the CBD to township projects along with key infrastructure projects. Furthermore, investors in the South will look for more opportunities in the Northern provinces. Last but not least, the COVID-19 vaccine is the key to open a new chapter of the market.

Notes on CBRE condominium ranking criteria:

- Luxury: projects that have primary prices over US$4,000 psm

- High-end: projects that have primary prices from US$2,000 psm to US$4,000 psm

- Mid-end: projects that have primary prices from US$1,000 psm to US$2,000 psm

- Affordable: projects that have primary prices under US$1,000 psm

(Selling price excludes VAT)