Ho Chi Minh City - 11 January 2021

HCMC Office Market

HCMC office market continued to go through a stagnation period in terms of performance due to COVID-19, which strongly affected many enterprises. In 2020, the market witnessed negative net absorption of -20,544 sqm NLA for both grades. 27% of major transactions collected and closed by CBRE were for contraction purpose, an increase of 12 ppts compared to 2018.

Despite of the severity of COVID-19, HCMC office market still received three new office buildings in the reviewed year, with Friendship Tower (Grade B) in Q1, UOA Tower (Decentralised Grade A) and Opal Tower (Grade B) in Q4, adding 65,372 sqm NLA to the current supply. The amount of new supply launched in 2020 is down by 31% compared to the average number of the past three years. As of Q4 2020, HCMC office supply reached 1,422,486 sqm NLA from 18 Grade A buildings and 68 Grade B buildings.

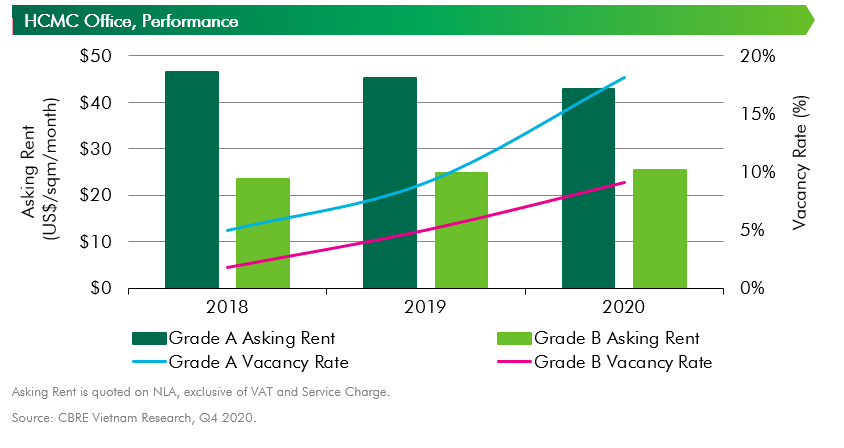

In 2020, Grade A vacancy was recorded at 18.1%, up 9.0 ppts y-o-y due to new supply launched to the market as well as many tenants in the reviewed year have contracted spaces either to exit the market or to relocate to cheaper options. Grade B vacancy also increased to 9.1%, up by 4.1 ppts y-o-y due to the introduction of Friendship Tower and Opal Office Tower. Additionally, some Grade B buildings in District 1 were recorded vacancy increase as some tenants scaled down spaces as well due to its currently high rental rate.

In the reviewed year, Grade A rent decreased by 5.3% y-o-y due the impact of UOA Tower, a new Decentralised Grade A building that offered an asking rent of US$23 psm pm, which is equal to half of the average asking rent of Grade A segment in the market. Landlords at some buildings also proactively adjusted asking rent downward to attract new tenants to back-up contracted spaces of old tenants. Some landlords maintained high asking rent but were more flexible in achieved rent, which allowing up to 20%-25% discount from the asking rent on top of flexible payment terms.

COVID-19 has changed the structure of office demand. If in the previous two years of 2018 and 2019, Flexible Workspace was conquering the market, being the top demand driver; in 2020, however, the sector was totally quiet with very limited transactions. Replacing Flexible Workspace; Retail/Trade/E-commerce, Information Technology and Manufacturing were the top three sectors the drove the market in the reviewed year with 53% out of the total major transactions closed and collected by CBRE Vietnam in 2020. Due to COVID-19, technology and online shopping utilisation have increased significantly, which led to the expansion of E-commerce companies in the reviewed year.

The pandemic also changed the real estate strategy of occupiers. Previously, employees were heavily relying on being in the office, however, they are now more flexible to work at different spaces. According to a survey conducted by PwC, organizations tend to restructure workplace model to a hybrid, which comprises of remote and office-based work, apart from reduce density in workplace. By this way, occupiers can save more rental cost on office leasing while still maintaining good business performance and healthy workplace for employees.

In 2021F and 2022F, the market is expected to have more than 150,000 sqm NLA from six new buildings of Pearl 5 Tower, Cobi Tower, The Graces, Saigon First House, Spirit of Saigon, and Etown 6. The pandemic is expected to be mitigated with the newly released vaccine and the market will start to recover in the next two years. Hence, although having more new supply, market performance is still projected to be positive. Rental rate of both grades will stay relatively stable with vacancy rates to gradually drop by years. Particularly, Grade A vacancy is forecasted to be 16% and 13% in 2021F and 2022F. Grade B vacancy is going to be 12% and 7% in the same projected years.

According to Ms. Pham Ngoc Thien Thanh, Associate Director, CBRE Vietnam: ”COVID-19 has reshaped the market’s dynamics, with unaffected sectors to keep driving the market demand in 2021. Additionally, tenants will start to pay more attention to all factors including saving rental cost, ensuring employees’ wellness while maintaining business performance. To do that, occupiers tend to adopt hybrid workplace model, design office with lower density and also diversify workplace into different sites such as decentralised options and co-working spaces. Additionally, the market in the next two years will be intensely competitive with a wave of new supply. To stay ahead of the competition, landlords should consider applying workplace strategy tools to evaluate current strengths and deficiencies of their buildings, in order to come up with an optimal solution to increase their assets’ values.”

HCMC Retail Market

There was not any new project in 2020 for HCMC retail market. However, the department store project of Parkson in District 1 was re-open in Q4 2020 with two new anchor tenants which are MUJI and Kohnan, next to the flagship store of Uniqlo opened previously. Therefore, new NLA in 2020 is 11,300 sqm, which is 90% lower than average amount of new supply in the past three years. As of Q4 2020, total new NLA in the market is 1,049,023 sqm.

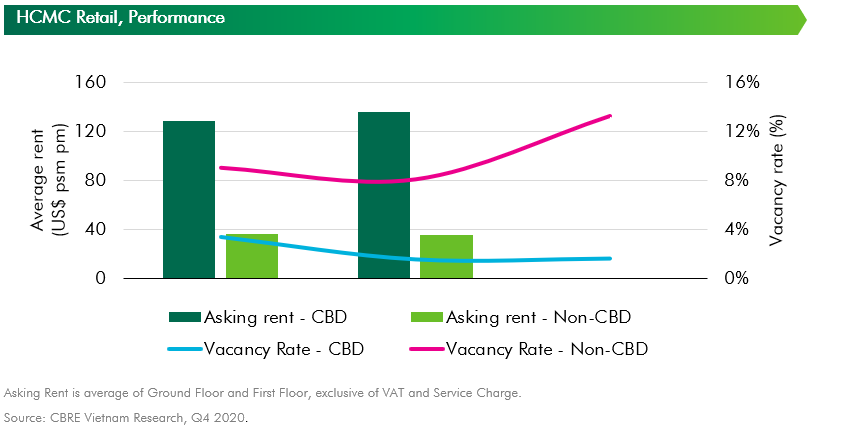

In Q4 2020, continuing the market recovery trend, vacancy rate improved in both CBD and non-CBD areas. Vacancy rate in the CBD was kept as low as 1.1% due to limited supply. Meanwhile, vacancy rate in the non-CBD was slightly down by 0.1 ppt q-o-q yet was up 5.1 ppts y-o-y and stood at 13.2% at the end of 2020.

CBRE recorded the uneven recovery trend across different locations. For example, vacancy rate at good quality retail projects in District 1, District 2 and District 7 all recovered, some even achieved better vacancy rate compared to same period of last year. In the meantime, retail spaces at non-CBD areas where customers’ purchasing power are more prone to effect from COVID-19 witnessed significant increase. The most impacted retail format is podium of condominium. In terms of vacancy rate increase by district, District 6, District 4, District 5 had vacancyy rate increase by more than 15 ppt; District 11, Tan Phu District, District 10, District 2 had vacancy rate increase by 5-10 ppt. Other districts have vacancy rate increase by less than 3.5 ppt.

Also, in Q4 2020, CBRE reported that some shopping centres in the non-CBD started to decrease their asking rental rate, mostly by 3-5% q-o-q while there were some other projects had to drop their rate by 8-15%. However, these are projects that had had low level of traffic as well as vacancy rate of over 15% at pre-COVID area. Rental rate in the CBD was kept stable, meanwhile. As of Q4 2020, asking rent in CBD was US$135.5 psm pm, stable y-o-y and q-o-q. Asking rent in non-CBD was US$34.4 psm pm, down by 3.9% q-o-q and down by 3.8% y-o-y.

Leasing remand started showing sign of recovery since Q2 2020 and most demand came from strong local retailers of F&B, fashion and accessories and pharmacy, especially. These retailers usually received favourable offer from landlords such as rent discount of up to 10% in the CBD and up to 15-20% in the non-CBD. Besides rent support, however, there was limited change in other leasing terms such as turnoveshare, lease term, Force Majeure regarding the pandemic. This is good times for retailers to search for quality retail space at discount. For foreign brands, there were significant decreased in terms of number of new entrants compared to previous years. Almost future brands area in the market study stage and wait for vaccine to show its effectiveness prior to opening new stores in Vietnam. According to CBRE, most these foreign brands come from South East Asia and in mid-end segment.

In 2021, the market will receive almost 60,000 sqm NLA from the re-opening of Union Square in District 1 and the new opening of Socar Shopping Mall in District 2. Rental rate and vacancy rate are expected to be stable in first half of 2021 before clearer signs of recovery in terms of leasing activities and market performance to be shown in the second half of the year. Top leading categories continue to be F&B, Fashion & Accessories while other categories such as Automotive, Home Décor and Furnishing, Luxury, etc. will further their expansion demand. From 2022 onwards, most of future supply will be clustered in the East as well as the CBD area. The coming of Metroline No. 1 is expected to bring new level of rental rate in the CBD area. In the following five years, the market expects to have over 500,000 sqm of NLA coming online.

HCMC Condominium Market

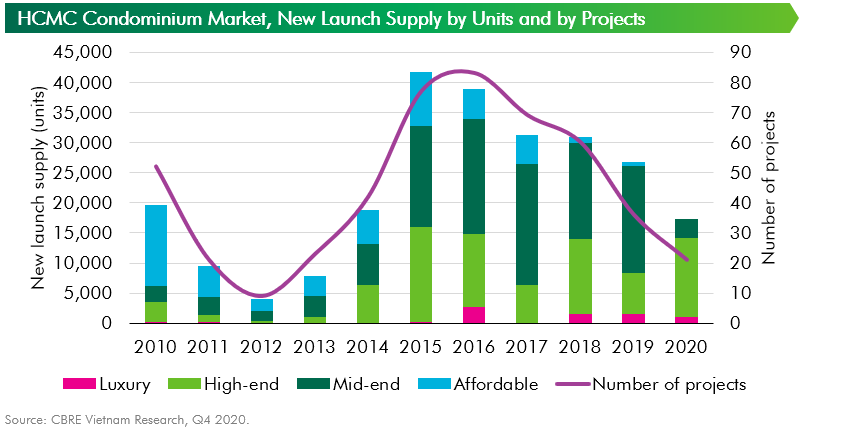

In 2020, condominium recorded a significant drop in new launch supply due to two main reasons. Firstly, slow licensing process for new projects and those seeking alterations master plan led to delay in official launches. Secondly, in order to slow the spread of COVID-19, social distancing, travelling restriction and partial closure of international flights had rescheduled many launching events that were planned in 2019. In the context of limited supply, primary price increased significantly to new level, especially in suburban districts.

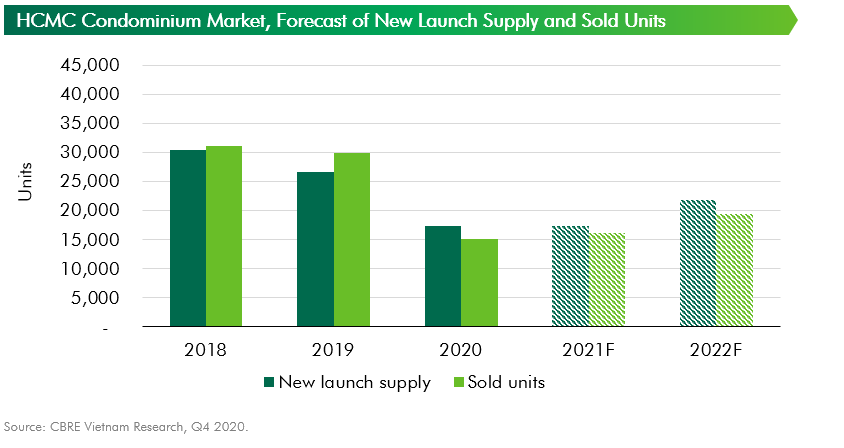

New launch supply by number of units in 2020 reached 17,272 units, a decrease of 35% y-o-y. This is the lowest number of supplies in the last six years. The market was on downward trend in five consequent years. A total of 21 projects were launch in 2020 compared to 36 projects in 2019. New launch supply in Q4 2019 were 6,696 units from six projects.

In terms of segment, there was no new affordable project while high-end segment recorded the highest proportion, 76% of total new launch supply, for the first time. Mid-end accounted for 17% and luxury segment accounted for 7% from two projects (The River and The Metropole).

In terms of location, the East area accounted for 91% of new launch supply by number of units and 43% by number of projects thanks to a township project in District 9. The official formation of Thu Duc city in 2021 is expected to transform the East area landscape and increase new launch supply. The South area accounted for 38% by number of projects and only 7% by number of units. No new supply in the Central and the North due to lack of land bank.

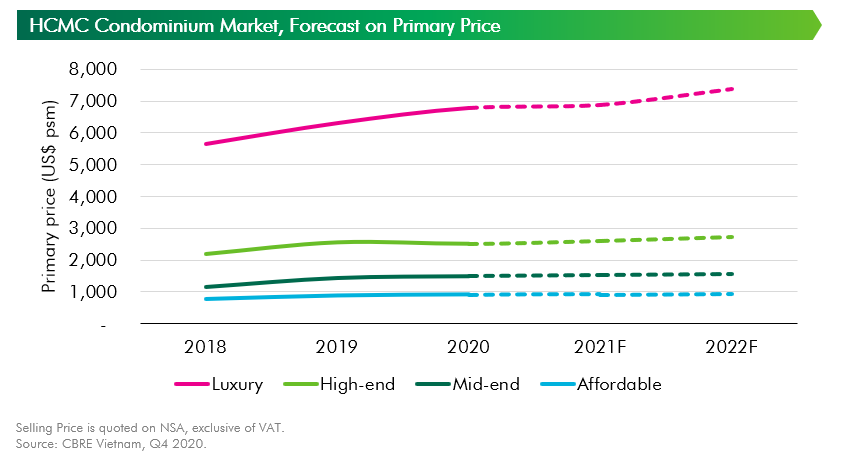

The average selling price for the primary market was at USD2,150 psm, up by 9% q-o-q and 13% y-o-y. Increases in primary price because of most of supply are high-end and luxury products. Furthermore, primary selling price of new launch supply in suburban districts increased by 20%-30% compared to current price levels in each location. Luxury primary price increased by 9% y-o-y which was the highest growth rate among four segments. High-end prices recorded a slightly reduction of 1% y-o-y because of new launched supplies in suburban districts had levelled up from mid-end to high-end segment. Average primary prices in mid-end and affordable increased by 5% and 4% y-o-y, respectively.

Sales performance was affected by high selling price and COVID-19. In terms of sold rate of newly launched project, only 75% of launched supply was sold which was lower than 90% in 2019. High-end inventory increased significantly by 74% y-o-y. Q4 2020 added 5,007 sold units to achieve a 2020 total of 15,086 sold units, a reduction of 49% y-o-y. Limited supply in primary market led to more active secondary market, especially in the East districts including District 2 (Thu Thiem, An Phu, Thanh My loi) and Binh Thanh District. Secondary selling prices in these locations increased by 30%-50% compared to launched prices according to successful CBRE’s secondary transactions.

In 2021, there will be no significant change in the market, however, the market will improve. It is expected to welcome approximately 17,500 units in suburban districts including subsequent phases of Vinhomes Grand Park, Masterise Centre Point (District 9) and first launching event of Masterise Lumière Riverside, Laimian City (District 2) in the East; AIO City (Binh Tan) in the West; Pi City (District 12) in The North; and the South area with subsequent phases of Sunshine City Saigon, Sunshine Diamond River (District 7) and Celesta Rise (Nha Be).

Primary prices will continue to increase with slower pace to absorb remaining units. Primary prices will increase by 1%-4% y-o-y in all segment except luxury segment. Luxury segment will increase by 2%-7% in 2021 and 2022 thanks to branded residence projects in District 1.

The secondary market will be more active due to lack of supply in primary market and new pricing level across the market. End-users may find limited options on the primary market and may turn to secondary market which offers both completed projects and those with good construction progress. Taking a wider view to surrounding provincial markets, limited supply in HCMC will force buyers to look for investment opportunity in Binh Duong, Dong Nai and Long An. These markets are expected to grow further in 2021.

Looking forward, Ms. Duong Thuy Dung, Senior Director of CBRE Vietnam, notes: “Despite of many challenges ahead and uneven recovery roadmap, condominium market will continue to attract buyer interest for living and investing purposes. Furthermore, positive signal from key infrastructure projects such as the construction of Long Thanh International Airport and the official formation of Thu Duc City will be key driver of the market to restart.”

Notes on CBRE condominium ranking criteria:

Luxury: projects that have primary prices over US$4,000 psm

High-end: projects that have primary prices from US$2,000 psm to US$4,000 psm

Mid-end: projects that have primary prices from US$1,000 psm to US$2,000 psm

Affordable: projects that have primary prices under US$1,000 psm

(Selling price excludes VAT)

Vietnam Industrial Real Estate Market

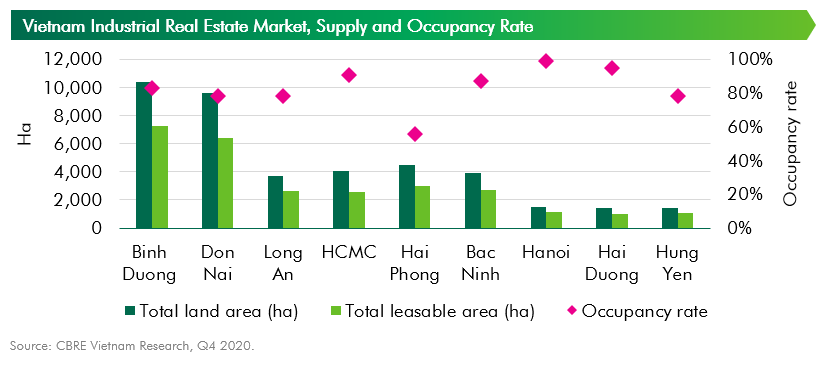

During the COVID-19 pandemic, the industrial market is the only real estate sector that witnessed positive progress in both rental rates and occupancy rates. As of Q4 2020, average occupancy rates of existing industrial parks since 2019 in five key Northern industrial cities and provinces (Hanoi, Bac Ninh, Hung Yen, Hai Duong, and Hai Phong) reached 89.7%, a 2.1 ppts increase y-o-y. Similarly, the occupancy rate of four key Southern industrial cities and provinces reached 87.0%, a 2.5 ppts increase y-o-y.

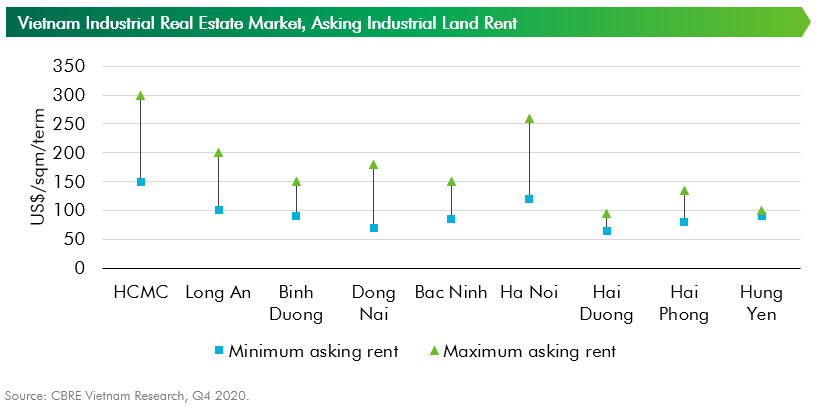

Due to the production movement from China as well as EVFTA, demand for industrial land is increasing across Vietnam. CBRE recorded that asking rents in some industrial parks in Hai Phong, Bac Ninh and Hai Duong in the North and Ho Chi Minh City, Dong Nai and Long An in the South increased from 20% to 30% y-o-y.

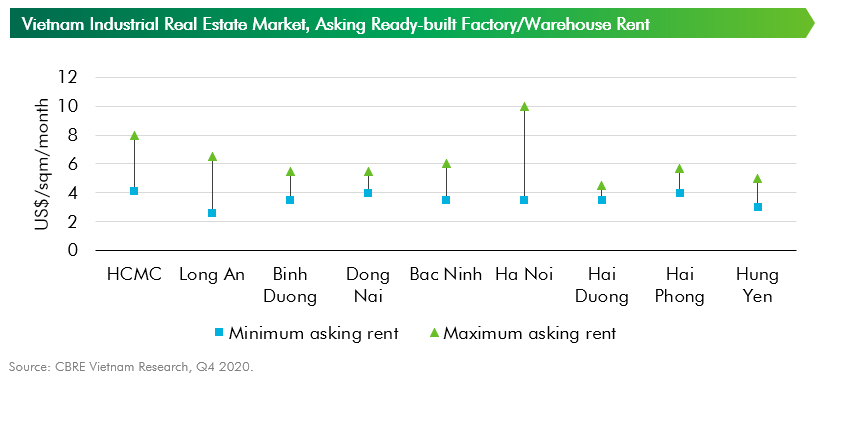

Performance of ready-built factory and warehouse market remained stable y-o-y due to large supply added in 2019 and 2020 as well as delayed leasing activity from travel restrictions. The strong growth of e-commerce and logistics companies since the outbreak of COVID-19 boosted demand for storage space and distribution facilities. As a result, the need to find a land bank for developing logistics facilities increased significantly, reflected in the 20% of total inquiries for this sector, recorded by CBRE. In prime locations with limited industrial land supply, high-rise warehouses have also begun to emerge to create larger storage space for the needs of e-commerce companies, especially as last-mile delivery locations.

With its resilience during the pandemic, the industrial sector in Vietnam became an attractive opportunity for both international and local players. In 2020, despite the pandemic, international warehousing giants such as GLP, LOGOS, and JD.com entered and heavily invested in both Northern and Southern of Vietnam. Vingroup, a major local real estate developer, recently joined the market with two new industrial parks expected to be ready in 2021.

Expansion of existing factories and new construction of manufacturing facilities in the context of accelerated relocation strategy will be the main source of demand in the coming time. While industrial land rent has reached a high level in well-located industrial parks, tenants have to seek new land supply in areas that are further from existing industrial hubs. In addition, industrial real estate developers are making changes in product development to adapt to the new situation. Outstanding features are the application of modern technology to management and operation of the facility, providing service packages including legal, human resources to help customers save time and costs during project implementation. This is gradually creating a new model of industrial real estate development in Vietnam which integrate industrial property provision and investment as well as management support services.

Note:

Asking rent of industrial land and Warehouse/Ready-built factory does not include VAT and Management fee.

Asking rent of industrial land is calculated for remaining lease term of a project (which is normally from 30 to 45 years).