Condominium

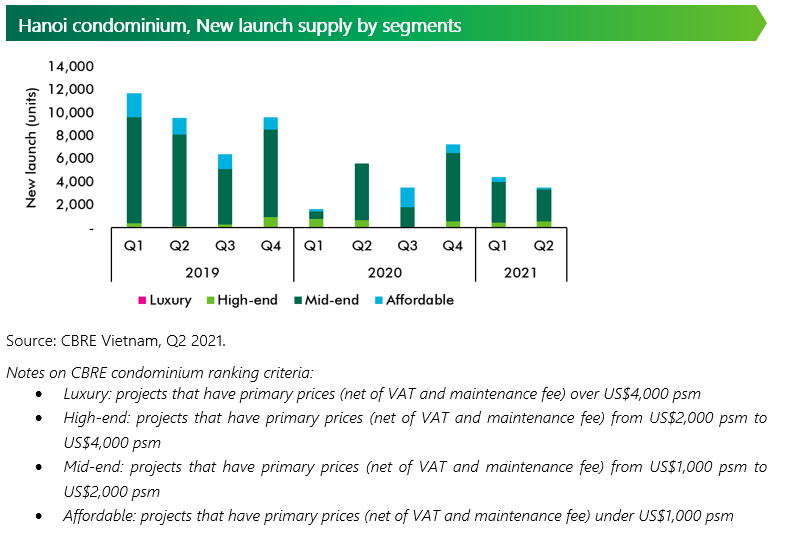

In the first half of 2021, there were approximately 7,900 condominium units launched in Hanoi, up 10% y-o-y. Although, there has been some negative impacts from waves of Covid-19 on Hanoi residential market in H1 2021, the increase in new launch shows recovery of sales activities and adaptation of both developers and buyers to the new market situation, compared to previous year when Vietnam witnessed the first waves of Covid-19. Mid-end apartments remained the most popular products offering to the market. This segment accounted for 79% of total new launch during the first half of this year. In terms of location, the West and the East led the market with relative equal shares of around 39% of total new launch during the first six months of 2021.

In terms of sales performance, positive market sentiment continued as sold units surpassed new launch in H1 2021. The sold units recorded in the first six months of 2021 is 8,100 units up by 20% y-o-y.

In Q2 2021, the average primary price of Hanoi market was recorded at US$1,472 psm (net of VAT and maintenance fee), up by 7% y-o-y and 1% q-o-q. In the secondary market, the selling price as of Q2 2021 averaged at US$1,180 psm, up by 4% y-o-y. Recently completed mid-end projects in convenient locations with improved connectivity in Hai Ba Trung and Bac Tu Liem districts are those witnessed strongest growth over the past year. Selected projects recorded an annual growth of 8 – 9% pa. Although this growth rate is higher as compared to those of previous years, it is still lower than level of HCMC’s, where witnessed projects with pricing growth of 10 – 15% pa.

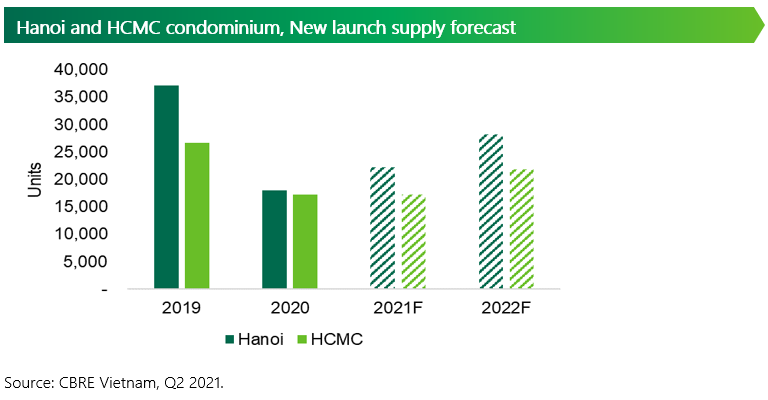

Moving forwards, the level of the new launch is expected to hover around 21,000 – 24,000 units in 2021, while sold units are expected to stay at positive level surpassing the new launch. The forecasted new launch and sold units during 2021 is higher than that of 2020, but still lower than pre Covid-19 level. It is anticipated that the level of new launch in Hanoi in 2021 – 2022 will be higher than that of HCMC by 25 – 30%. The primary price in the next two years is expected to grow at 4 – 6% pa, higher than previous year level of 3% thanks to improving infrastructure system and lower supply volume (as compared to pre Covid-19 level). Ms. An Nguyen – Director of Hanoi Branch, CBRE Vietnam noted “We expect that not only developers from the South are heading North for new development opportunities, but individual buyers, especially investors, from Southern provinces will start to look for new opportunities in Hanoi and Northern provinces as supply constraints continue to be an issue in HCMC”.

Office

In H1 2021, Hanoi office market did not record any new projects. Total Hanoi office supply in both grades remained at 1.5 million sqm NLA, with 35% of total supply coming from Grade A projects.

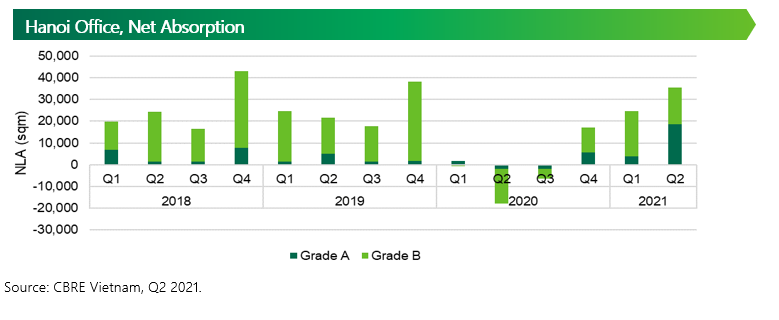

In H1 2021, office market in Hanoi and HCMC continued to show signs of recovery, although the Vietnamese economy is still affected by the COVID-19 epidemic. In H1 2021, net absorption of Hanoi and HCMC office market reached 60,000 sqm and 33,000 sqm respectively. These figures improved significantly compared to H1 2020, when the pandemic started to affect the market (absorption rates in Hanoi and HCMC in the H1 2020 was negative 17,000 sqm and negative 3,800 sqm respectively).

With the recovery in the absorption rate of the office market, the vacancy rate of the Hanoi office market continued to decrease in both grades. Vacancy rate of Grade A office decreased to 18.9%, down by 3.5 ppts q-o-q and up by 11.3 ppts y-o-y. Vacancy rate of Grade B office dropped by 11.5%, down by 1.7 ppts q-o-q and up by 0.6 ppts y-o-y.

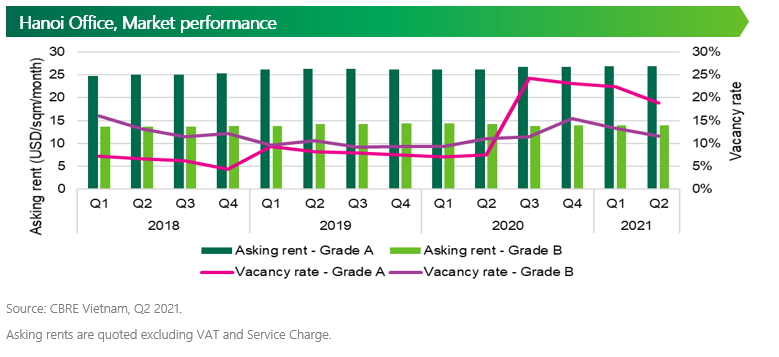

Despite a decline in vacancy rate, average asking rents in both grades remained stable q-o-q. In Q2 2021, Grade A asking rents reached $26.9/sqm/month, up by 0.1% q-o-q and 3.0% y-o-y. Meanwhile, Grade B office rent remained at $14.0/sqm/month, same as previous quarter.

In the next few years, Hanoi market is expected to welcome many major pipelines. In H2 2021, Hanoi office market is expected to welcome about 180,000 sqm of new office space, and more than 150,000 sqm in the following years. Several new projects announced a focus on green credentials, such as Techno Park Tower, Lancaster Luminaire or 36 Cat Linh, forming an emerging trend in office buildings in Hanoi.

In H1 2021, the contraction trend decreased significantly compared to 2020. The proportion of contraction transactions in Hanoi decreased from 17% in 2020 to 0% in H1 2021. Similarly, the contraction proportion in HCMC decreased from 27% to 3%. In terms of industries, the Banking/Finance/Insurance and Technology/Media/Telecommunications (TMT) sectors continues to be the main demand drivers of the market.

After 2020 with negative absorption rate due to the impact of COVID-19 pandemic, Hanoi office market showed some signs of recovery. According to CBRE's survey in the APAC, about 70% of businesses in APAC are currently recovering, and will continue to recover in the next 6 months. Under the impact of the pandemic, more companies will adopt a remote working policy, increasing from 63% in Q3 2020 to 74% in Q2 2021. Net absorption rate is expected to increase, reaching from 70,000 sqm to 80,000 sqm in 2021. Average asking rents of existing projects are expected to remain stable in H2 2021.

Retail

In Q2 2021, under the 4th wave of COVID-19, the retail sector was significantly impacted. Limited vaccination rate throughout the country, along with strict pandemic prevention measures implemented in Hanoi, most notable being the suspension of street-side restaurants and cafes from the 3rd of May, has partly affected the retail market. According to statistics from Google, while the number of visitors going to shopping malls and retail spaces seemed to increase and showed great potentials to recover in Q1, in Q2, this number has decreased significantly. Overall, compared to the same period from last year, the retail market currently has not been significantly recovered.

In terms of supply, the Hanoi retail sector did not record any new project coming into operation in the second quarter of 2021. Retail current supply remained unchanged at more than one million sqm, NLA.

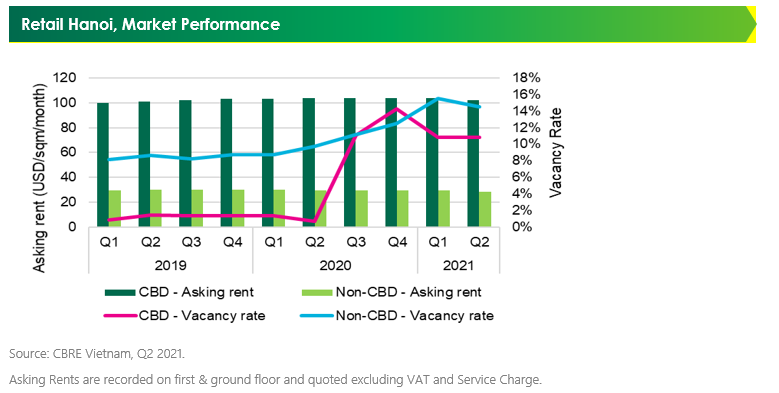

Asking rents on the ground floor and the first floor (excluding VAT and service charges) in non-CBD locations continue to decrease due to a number of projects with high vacancy rates proposing discounts to attract new tenants, as well as retaining existing tenants to stabilize occupancy rates. Asking rents decreased by 3.8% y-o-y and 2.8% q-o-q, averaging US$29/sqm/month. Vacancy rates remained at a high level, reaching 14.6, up 0.1 ppts q-o-q and 4.8 ppts y-o-y. In HCMC market, under the pressure of the latest pandemic wave, asking rents reached US$34/sqm/month, a decrease of 5.2% y-o-y. As malls were closed under the current lockdown in HCMC, landlords were expected to reduce rental fees, as well as offer policies to support tenants during the affected period. A few additional stores were opened during the quarter, while no record yet of tenants moving out under the current lockdown, leading to average vacancy recorded at 1.6ppts lower y-o-y, reaching 14.6%.

Average asking rents in the Hanoi CBD area saw a drop of 1.9% q-o-q and 1.7% y-o-y, reaching US$102/sqm/month. Vacancy rates in the CBD reached an average of 10.8% as certain lots on higher floors remained vacant under prolonged impact of the pandemic. Compared to the same period last year, this rate had increased by 10.1 ppts y-o-y.

In terms of tenants, despite the complicated development of the pandemic situation, Hanoi retail market witnessed the entry and expansions of many familiar fashion, cosmetic, cuisine and retail brands. Noticeable entry in the Hanoi market includes Garmin with its first flagship store at 8 Phan Boi Chau street, and Kon&Co, a Korea’s retailing brand, in AEON Mall Ha Dong. MUJI, having its first store opened on July 4 at Vincom Center Metropolis, was one of prominent expansion brands during the last quarter. HCMC also witnessed popular brands entering and expanding in the market, most noticeably being Rolls-Royce, a luxury automobile brand, entering Vietnam market for the first time. Despite the impact of the pandemic, expansions and M&A activities brought potentials for the market to quickly recover. It is expected that in the coming quarters, fashion brands, F&B brands and supermarkets will continue to launch in Hanoi, making the retail market more vibrant.

In the last two quarters of 2021, Hanoi retail market is set to welcome 82,000 sqm NLA of retail space, including the most significant project Vincom Mega Mall Smart City, expected to launch in Q3. In addition, after 2021, an additional of almost 300,000 m2 NLA is expected to enter the market. These new projects will be located in non-CBD area. Residents in the North and South of the city and the surrounding area will have more options to shop and use the services when two large-scale projects, Lotte Mall Hanoi and Aeon Mall Hoang Mai, expected to be completed in 2023-2024.

Overall, expansion, merger activities along with new project openings will improve the retail market for the coming period once the pandemic is contained. Factors expected to foster the recovery of the market include the development of omnichannel, support for tenants, and most importantly the pandemic containment measures of the government, with the determination to vaccinate 70-75% of the population by Q1 2022 brings potential for the recovery of the retail market. However, it will take some time for the market to restore to its pre-pandemic level.

Northern Industrial Real Estate Market

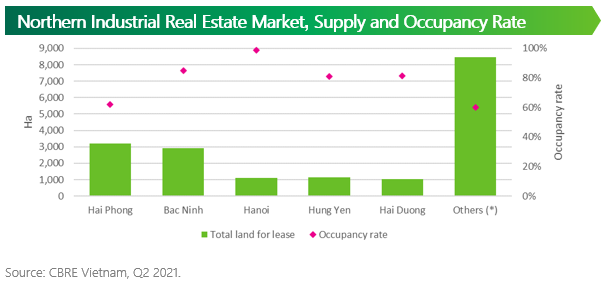

In H1 2021, despite the impact of COVID-19, industrial land market still remained positive in term of rents and occupancy rates. In Q2 2021, average occupancy rate in major Northern industrial provinces and cities (Hanoi, Bac Ninh, Hung Yen, Hai Duong and Hai Phong) reached around 80%. If including adjacent provinces (Thai Nguyen, Vinh Phuc, Quang Ninh, Ha Nam, Nam Dinh, Ninh Binh, Bac Giang), the average occupancy rate of industrial land stayed at 69%.

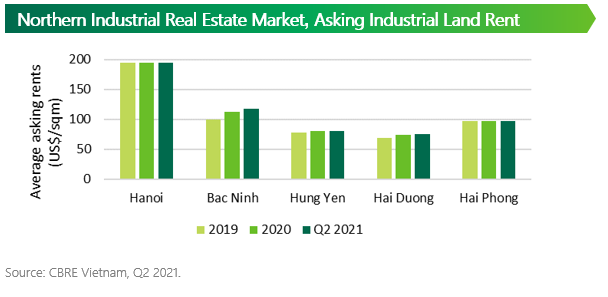

Compared to 2020, the rental growth rate of Vietnam industrial land market slowed down in both Southern and Northern regions. The rental growth rate in the major Northern industrial provinces and cities ranged between 0% and 5% in H1 2021, lower than the growth rate of 4% to 13% in 2020. Asking rents of most industrial parks remained stable compared to Q4 2020, except for some projects at prime locations in Bac Ninh, Hai Phong, Binh Duong, Dong Nai or Long An, which achieved a growth rate of 5% to 10% in H1 2021.

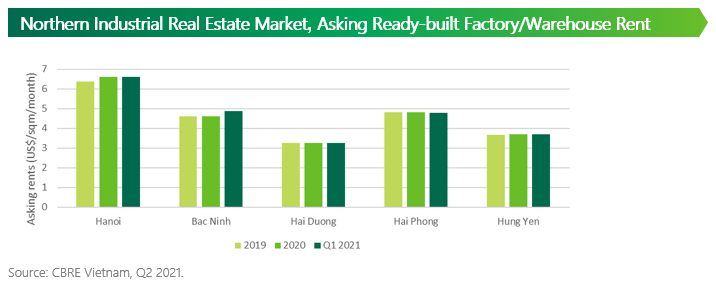

Performance of ready-built factory and warehouse market remained stable y-o-y. In H1 2021, average occupancy rate in Northern cities and provinces was above 90% due to limited new supply. Asking rents of warehouse and ready-built factory in H1 2021 remained stable compared with 2020.

Demand for industrial real estate mainly comes from electronic components, automobile, packaging and logistics companies. Amongst those, the strong growth of logistics companies since the outbreak of the COVID-19 boosted the demand for storage space, increased the demand for land bank to develop logistics facilities, as the proportion of inquiries for logistics land increasing from 30% in 2020 to 39% in H1 2021.

With the strong growth of the industrial real estate during the pandemic, many new investors decided to enter the market, including domestic developers (Vinhomes, Thanh Cong Group) and foreign developers (JD.com, Fraser, ESR). In addition, investment funds have also participated via investment into potential projects such as Actis, who recently announced an investment into a local industrial park operator. From now to 2023, supply of industrial land in the North is expected to increase by an average of 7.4% per annum, while the supply of warehouse and ready-built factory is also expected to increase by 46% and 10% per annum, respectively. The entry of new investors will increase the supply of industrial real estate as well as the competitiveness in quality of infrastructure and services. Future projects are expected to be of better quality and will be offered at above market average. Demand is expected to sustain in all three sectors. However, major pipeline in the next three years will potentially create pressure across all sectors; as such older projects would likely keep their rental policies stable to remain competitive.

Note:

- Asking rent of industrial land and Warehouse/Ready-built factory does not include VAT and Management fee.

- Asking rent of industrial land is calculated for remaining lease term of a project (which is normally from 30 to 45 years).